Bitcoin Experiences Sharp Decline as Investor Enthusiasm for Crypto Fades

Bitcoin plunged over 5% during European trading on Monday, falling below €75,000 after previously hitting a peak of about €110,000 in early October. The cryptocurrency has endured a persistent decline throughout November, shedding more than 16% of its value amid widespread liquidation and sell-offs.

Other major cryptocurrencies faced similar losses, with Ethereum and Solana dropping more than 5% during the same period. This continues a downward trajectory that began in October and reflects broader investor reluctance toward volatile digital assets.

Despite attempts at recovery last month, Bitcoin’s price rebounds proved temporary, and the downward momentum resumed. Market participants are increasingly retreating toward low-risk investments as uncertainty clouds global markets, especially with diminishing expectations for early interest rate reductions by central banks like the US Federal Reserve and the Bank of England.

Bitcoin exchange-traded funds (ETFs) have seen low inflows, signaling weak demand from institutional and retail investors alike. ETFs offer exposure to multiple assets through a single product, but as prices of component assets fall, ETF shares often decline, amplifying selling pressure.

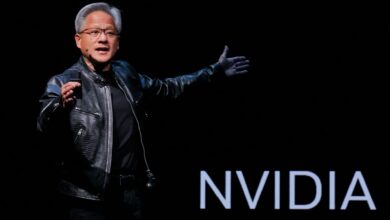

Experts attribute part of Bitcoin’s slump to aggressive trading strategies by professional investors. Rather than emerging as a digital safe-haven akin to gold, the cryptocurrency behaves more like volatile tech stocks. For example, Nvidia, a leader in GPU technology, had a strong run this year but experienced similar sharp drops recently, highlighting the parallel in investor sentiment.

Several factors combined have triggered the crypto sell-off:

- Global market uncertainty affecting risk appetite

- Lower expectations for central bank rate cuts

- Low inflows into Bitcoin ETFs

- Professional traders using aggressive techniques

As cryptocurrencies continue to lose favor amidst financial market turbulence, Bitcoin’s future trajectory remains closely tied to broader economic signals and investor confidence.

Read more at: ca.finance.yahoo.com