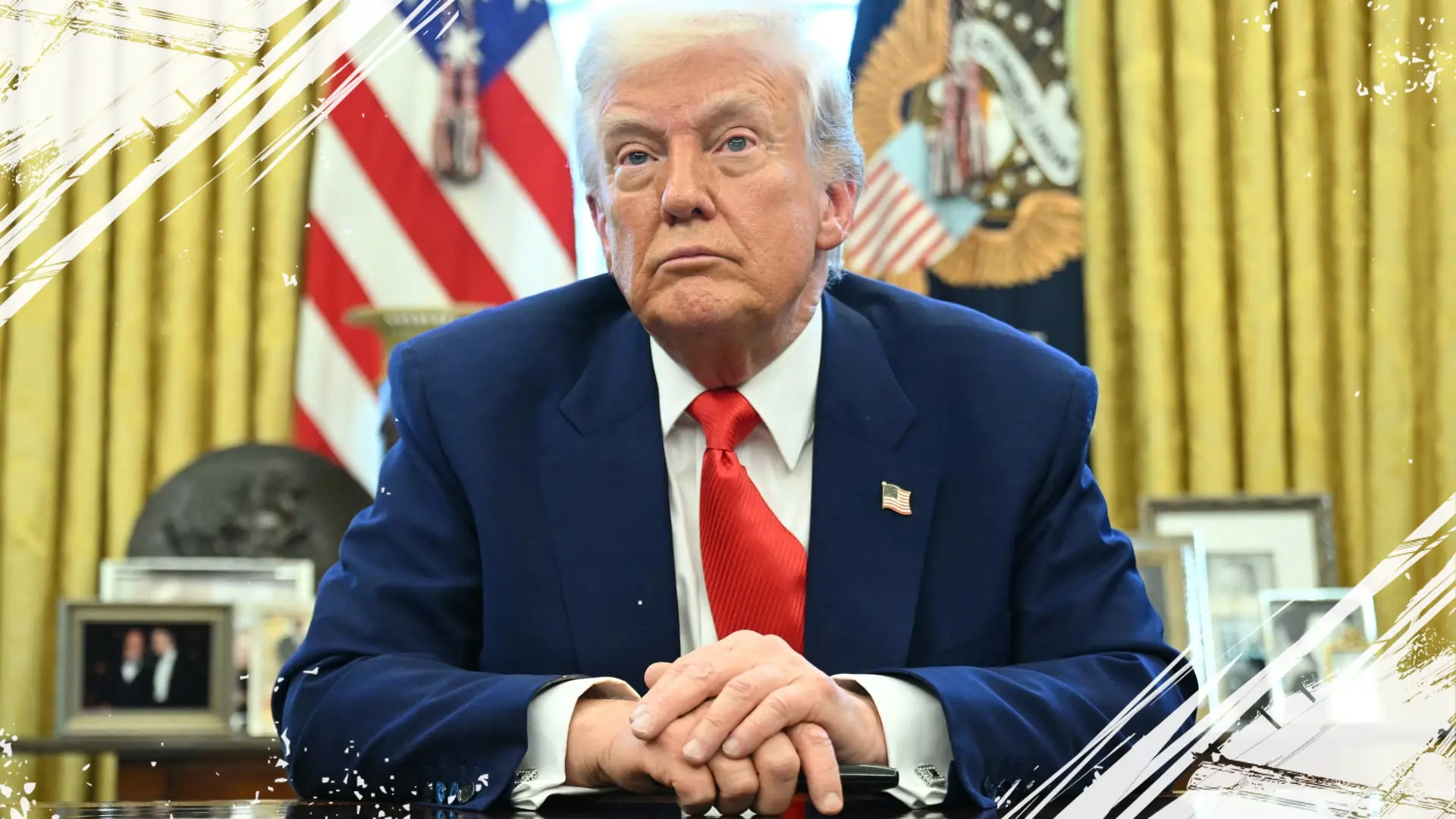

U.S. President Donald Trump has issued an executive order mandating a Chinese-controlled company to unwind its recent acquisition of sensitive semiconductor assets, citing national security risks. The move targets HieFo Corporation, which acquired digital chip and wafer fabrication assets from Emcore, a New Jersey-based manufacturer, for $2.9 million.

The White House clarified that HieFo is controlled by a citizen of the People’s Republic of China. The assets involved include semiconductor manufacturing facilities critical to digital chip production. Officials expressed concern that the acquisition could impair U.S. national security by potentially diverting key technology and components.

The Treasury Department emphasized that the deal had not been presented to the Committee on Foreign Investment in the United States (CFIUS). This omission triggered a review by CFIUS’s non-notified transactions team. The department found significant security risks linked to the access gained by HieFo to Emcore’s intellectual property and proprietary expertise.

Among the facilities and technologies involved, indium phosphide chips manufactured by Emcore are of particular strategic importance. These chips serve various applications including commercial, industrial, and defense systems. Emcore’s portfolio includes navigation equipment such as gyroscopes and sensors used in autonomous navigation and weapons systems.

HieFo was ordered to divest all acquired assets within 180 days. Additionally, the company must immediately restrict any access to Emcore’s technical information. This enforcement action aims to prevent the transfer of sensitive technology to foreign entities that could threaten national security interests.

The executive order follows HieFo’s acquisition closing in late April. The company, founded by Genzao Zhang and Harry Moore through a management buyout, had expressed intentions to continue operations at Emcore’s Alhambra, California facility. HieFo claimed to have retained nearly all key scientists, engineers, and operational staff involved.

Emcore was delisted from Nasdaq after merging with aerospace holding company Velocity One LP in November. Despite the divestment order, the company’s legacy in optoelectronic innovation, especially in indium phosphide chip manufacturing, represents decades of technological development now subject to intensified scrutiny.

The Global Times, a Chinese state-affiliated media outlet, criticized the U.S. decision as reflecting Washington’s anxiety over technological competition. It stated the action lacked convincing rationale, underscoring the ongoing tensions between the two countries over advanced technology transfers.

The Trump administration’s decisive intervention marks a continuation of heightened U.S. vigilance over critical technology transactions involving Chinese-controlled firms. The legal measures aim to maintain control over strategic semiconductor resources amid growing geopolitical competition.

Key points of the executive order and Treasury findings include:

1. Identification of HieFo as a Chinese-controlled entity acquiring U.S. chip technology.

2. Absence of CFIUS notification prior to the transaction.

3. National security risks from possible transfer of Emcore’s specialized intellectual property.

4. Mandatory divestment timeline of 180 days for HieFo.

5. Immediate restrictions on HieFo’s access to Emcore’s technical data.

This development highlights the ongoing complexity of regulating foreign investments in critical U.S. industries. It underscores the sensitive nature of semiconductor manufacturing amid global supply chain challenges and strategic competition. The regulatory scrutiny aligns with broader efforts to safeguard national technological assets in the face of evolving international threats.

Read more at: www.cnbc.com